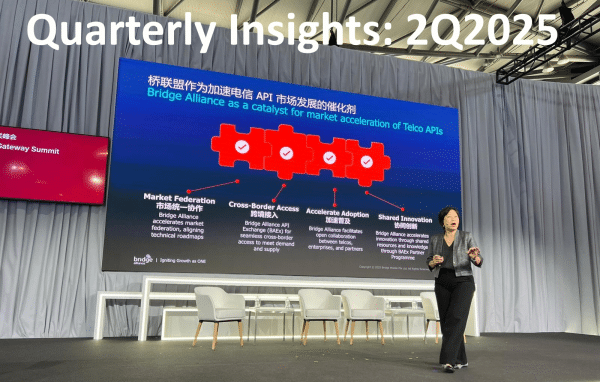

Our CEO Geok Chwee presenting at the MWC Shanghai 2025 Open Gateway Summit.

Hi all!

Welcome to the 2Q2025 edition of our insights on Bridge Alliance and Bridge Member Operators!

This quarter’s developments reflect that telcos are deeply transforming their own operations and ecosystems and that the telecom industry is undergoing a structural transformation as operators shift from being commodity connectivity providers to solution enablers for enterprise clients.

- Telcos are increasingly becoming tech companies/integrators. Partnerships with hyper-scalers and software firms mean telcos must sharpen skills in cloud management, software development (APIs, automation), and solution integration.

- New revenue streams are on the horizon but will require execution. Private networks, IoT, and security services can fetch higher margins than commodity mobile data, but telcos face competition from both traditional rivals and new entrants (cloud providers, system integrators).

- Growing threat looms from low-cost challengers to established telcos. While the latter need to figure out a robust response to the risks to their core business, there seems to be a renewed emphasis on enterprise products to drive new revenue growth. Increasing resources for the enterprise division has been the revenue growth strategy for many operators.

- As telcos infuse AI into networks and customer interactions, leadership must ensure robust governance. For instance, AI managing critical infrastructure (like emergency calls routing, or network fault resolution) is high stakes. Telcos should implement strong testing and fail-safes and possibly get external audit of the AI models to ensure reliability.

- Cloud and edge computing featured strongly as well. Multiple telcos strengthened ties with cloud providers or unified their cloud offerings. We are seeing telcos becoming cloud service providers themselves: DT launched T Cloud to unify all its various cloud solutions, from public cloud resale (e.g. AWS, Azure partnerships) to DT’s own Open Telekom Cloud and edge cloud, plus cloud professional services. Essentially, a one-stop-shop for enterprise cloud needs, reflecting telecoms’ strategic shift into IT services.

- Striking a fine balance in the ecosystem play is key: The success of many initiatives will depend on managing complex partnerships. Telco leaders should watch that their organisations remain in the driver’s seat of innovation and customer relationship, rather than ceding too much control to big tech partners. A key watch-point is the balance of power in telco-cloud vendor tie-ups.

This past quarter, Bridge Alliance sent a large team to the GSMA’s MWC Shanghai 2025 in June, where our CEO Geok Chwee updated the industry about our telco API initiatives at the Open Gateway Summit. We also held our IoT workgroup meeting and attended China Telecom’s Global Partner Conference in Shanghai. Thanks to all who attended for connecting with us! It was an extra fruitful trip as we returned with our very first Asia Mobile Award in the ‘Asia 5G Industry Innovation’ category for our Bridge Alliance API Exchange!

Geok Chwee also participated in our strategic alliance partner FreeMove’s Summit in London in June, and exchanged views with FreeMove partners on what it means to stay connected and ahead in today’s mobile-first world.

Read on for more about the Bridge ecosystem’s activities in 2Q2025!

Cheers

Bridge Alliance Research and Analysis Team

Telco APIs

Following all the strong showing in 1Q and MWC Barcelona, many operators were relatively more muted on new Telco API initiatives during this quarter. Telcos across Asia were among the first to join the GSMA Open Gateway global framework for network APIs, as now the focus is on translating those announcements into live APIs and use cases. By mid-2025, the GSMA reported that dozens of network APIs were commercially available thanks to Open Gateway’s push to make mobile networks developer-friendly. Collaboration is not limited to operators either – tech vendors and integrators are key players in this ecosystem. CPaaS providers (like Vonage, Twilio, Sinch) and cloud giants (Google, Microsoft) are partnering with telcos to incorporate network APIs into their platforms.

We at Bridge Alliance continued to advance API adoption, launching our Bridge Alliance API Exchange (BAEx) Partner Programme in June and welcoming CelcomDigi. It allows all participating operators to benefit from a deeper involvement with BAEx with insights from API industry development and technical workstreams.

BAEx also continues to broaden its ecosystem collaboration by entering into a strategic partnership with leading technology solution provider Nokia. Nokia’s Advanced 5G and CAMARA APIs will be offered to enterprises over BAEx and Bridge Alliance’s APIs will be available on Nokia’s Network as Code platform with developer portal to end customers, expanding on both parties’ market reach and joint collaboration.

Meanwhile, one of our API partners Aduna is growing its ecosystem announcing new partnerships with companies from a broad spectrum, including Microsoft, Softbank, NTT Docomo, Syniverse, Wipro and Tech Mahindra.

Over in Australia, Optus launched its API Connect platform in partnership with Vonage. API Connect is positioned as a response to increasing demand for smoother integration of communications into digital business processes.

IoT/M2M/Mobility

IoT remains a steady focus, but with a shift toward large-scale platforms and enterprise applications. Many IoT announcements were effectively about enabling specific vertical solutions: e.g., Deutsche Telekom’s IoT-driven vehicle logistics automation with Unikie.

Additionally, new IoT connectivity solutions emerged in a trend towards more flexible IoT SIM/orchestration to support worldwide deployments.

We were delighted to partner Globe and Thales to power enterprise-grade IoT adoption in the Philippines, through a Proof of Concept (PoC) for the GSMA SGP.32 standard! We’re paving the way to enable IoT solutions that require flexible, scalable, and secure connectivity across a wide range of applications applications.

Singtel launched its enhanced Multi-Domestic Connectivity solution that enables global IoT deployments in partnership with floLIVE; while Optus delivered a tailored mobility solution (27,000 IoT SIMs to enable connectivity) for on-demand delivery platform Menulog.

Our IoT platform partner Aeris launched an expansion of IoT Accelerator, thus enabling Aeris and its mobile carrier partners to deliver a single-SKU eSIM to OEM and enterprise customers, providing a single-pane of glass in a global manner.

In Russia, China Telecom entered into a partnership with Russian operator MTS to jointly promote and develop IoT solutions in the local car market. Cooperation in this area had already begun back in 2020 with the implementation of a joint project for the automaker HAVAL.

In more connected vehicle news, SoftBank and its subsidiary Cubic3 have announced a strategic partnership to advance the seamless integration of satellite-based non-terrestrial networks (NTN) with terrestrial networks (TN) to create a ‘Ubiquitous Network’ for SDVs and other high-value mobile assets. Through the collaboration with the major satellite communications providers, both companies aim to advance the commercial deployment of a ‘Ubiquitous Network’ for connected vehicles within the next few years. Cubic3 has also announced plans with Viasat to create a ubiquitous, seamless satellite connectivity service allowing drivers to make calls and access critical safety services from almost anywhere on Earth. Live trials of the new service will begin in 2025.

Over in Greater China, PCCW Global has entered into a strategic collaboration agreement with Qianxun Spatial Intelligence Inc. (Qianxun SI), a spatiotemporal AI technology company based in mainland China, to bring high-precision positioning and BeiDou Navigation Satellite System (BeiDou) short messaging services for Hong Kong, Macao and Belt-and-Road areas. This provides effective support for applications such as low-altitude economy, autonomous driving, smart wearables, safety monitoring and power grid inspection.

AI

AI was again a prominent theme this quarter. Telcos are embracing AI for both internal network automation and new customer-facing services. Deutsche Telekom explicitly declared itself an “AI-first” company, integrating AI into operations and partnering with Google Cloud to apply AI at scale. Several press releases highlighted AI in network management – e.g., Airtel using Nokia’s GenAI automation for zero-touch network operations. On the service side, AI is powering new offerings; like Orange’s demos of AI assistants for banking and customer service, and Telefónica’s AI to monitor marine environments.

Some interesting announcements from the BMOs:

Deutsche Telekom and NVIDIA will build the world’s first industrial AI cloud for European manufacturers on German soil. In doing so, they will pave the way for the AI Gigafactory on the one hand and the opportunity to advance Germany as an industrial AI hub. Separately, DT has rolled out enterprise-grade networking to mid-sized companies, previously accessible only to large corporations, tapping on Telekom SD-WAN based on Juniper, an AI-native offering that powers a self-driving and self-healing network and issues monitoring.

Making AI more accessible to consumers is Optus, which has teamed up with Perplexity, the AI-powered answer engine, to offer eligible new and existing mobile customers a 12-month complimentary subscription to Perplexity Pro – valued at A$300 (US$177).

China Unicom has made a breakthrough in distributed AI model training across its network, positioning telecom operators for a more significant role in AI development as demand for decentralized training grows. It has successfully tested a method to train large AI models across multiple locations, which experts say could potentially reduce the hefty costs associated with training frontier AI models.

In the Philippines, Globe Telecom is leveraging AI to streamline operations, enhance decision-making, and drive efficiency across its business units while in Japan, SoftBank Corp. developed a Large Telecom Model to integrate gen AI with telecom domain-specific knowledge and real-world operational know-how.

In Japan, Nearthlab, a global leading drone AI company, has entered into a strategic MoU with SoftBank – marking a pivotal step in Nearthlab’s expansion into Japan’s advanced drone market. They will work together to accelerate the rollout of AiDEN, Nearthlab’s proprietary AI drone, along with its automated drone station.

Edge/MEC/Cloud

In the cloud space, multiple telcos strengthened ties with cloud providers or unified their cloud offerings.

AIS Business has officially launched “AIS Cloud powered by Oracle Cloud Infrastructure” — Thailand’s first world-class Hyperscale Cloud infrastructure, said to be the only service of its kind operated entirely by a Thai company, with local data centres located within the country and governed by Thai law. This ensures full compliance with cybersecurity standards while supporting customers to transition effectively into the AI era.

Stc Group also signed a partnership agreement with Oracle worth over two billion riyals (US$533 million) to develop an advanced cloud infrastructure based on AI; Stc aims to build an advanced cloud infrastructure supported by AI, relying on the Oracle Alloy platform. stc Group also announced a multiyear strategic partnership with Kyndryl, a provider of mission-critical enterprise technology services, to develop an advanced multicloud management platform strategy, aiming to simplify cloud adoption for stc customers and partners by enabling seamless integration of hyperscaler cloud services. Stc Group and Kyndryl will also leverage their combined capabilities to create new digital services.

Operators are not only leveraging cloud technologies to transform both IT and network functions, they are also becoming cloud service providers themselves: Deutsche Telekom earlier announced it has signed a long-term strategic agreement with Google Cloud till 2030, focusing on cloud and AI integration for DT’s IT, networks, and business applications. Separately, DT is now offering NVIDIA H100 Tensor Core processors for rent from the Open Telekom Cloud. The processors accelerate the training and use of artificial intelligence (AI) as well as high-performance computing.

Then in June, DT launched a bundled offering T Cloud to bundle all its cloud solutions, which means Telekom Deutschland and T-Systems will offer all cloud solutions (be it public or private cloud) from a single source in the future, guaranteeing a multicloud approach. Enterprise customers of all sizes can put together their own customised cloud offering from a comprehensive portfolio of solutions – at different levels of sovereignty, a response to the growing call for sovereign solutions that are secure, scalable and stable in Europe.

DT and the Finnish software expert Unikie are partnering to scale the automated vehicle logistics chain for Volkswagen tapping on edge cloud. Using SIM cards, the vehicles connect to DT’s 5G network and can thus communicate with the Unikie Marshalling Solution (UMS). The UMS is utilizing an external sensor infrastructure based on LiDAR (Light imaging, detection and ranging) sensors. This enables an accurate and safe automatic control of the vehicles – even in confined, densely trafficked areas with mixed traffic or in poor visibility conditions. Telekom operates the Unikie Marshalling Solution in an edge cloud to enable low latency times, fast and secure communication between the UMS and the vehicles almost in real time.

5G & Innovation

As they advance in 5G, operators are showcasing progress in 5G Standalone deployments and features. Many operators position 5G not just as consumer mobile broadband, but as a platform for enterprise services (private networks, slicing, IoT connectivity) and industry-specific solutions.

BMOs’ announcements reflect a broad range of activities.

Optus and Ericsson have partnered to deploy high-performance antennas to enhance coverage, capacity, and energy efficiency of Optus’ 5G network; Optus also launched a 5G Standalone Fixed Wireless Access (FWA) for its wholesale partners, enabling them to offer that service to their customers, built on a dedicated 5G core, not reliant on 4G infrastructure.

Airtel also ramped up its 5G SA capabilities, expanding its partnership with the deployment of Nokia’s Packet Core appliance-based and FWA solutions for providing a better network experience for Airtel’s growing 4G/5G customer base. The solution will help seamlessly integrate 5G and 4G technologies into a single set of servers. Airtel also awarded a multi-year NOC Managed Services (MS) contract to Ericsson to manage Airtel services across 4G, 5G NSA, 5G SA, Fixed Wireless Access (FWA), Private Networks, and Network Slicing, following the earlier announcement on collaboration with Ericsson on 5G Core to drive 5G evolution.

Airtel has also stepped up with several innovative consumer offerings, including new anti-spam initiatives, unlimited international roaming plans, cutting edge fraud detection solutions and ‘Business Name Display’ (BND), an industry-first solution designed to enhance customer engagement for enterprises.

Meanwhile, China Unicom and Huawei have recently signed an MoU to team up on IP self-intelligent network technology. The companies will cover standard formulation, technology research and development, application demonstration, industry promotion, and other related operations.

SK Telecom launched the ‘T In-Flight Wi-Fi Automatic Roaming’ service together with SK Telink; customers can automatically connect to in-flight Wi-Fi without a separate authentication process simply by signing up for the service before boarding the plane.

In a major push for sustainability, Maxis has expanded access to green energy with its Home Solar solution across Peninsular Malaysia, enabling customers to reduce their carbon footprint and electricity costs. It aims to provide a complete, worry-free experience to homeowners, allowing them to subscribe to a solar energy system with a low upfront payment that covers solar panels, inverters, along with installation, maintenance and proactive monitoring.

Private Networks

Telcos are using private networks to target industries like manufacturing, logistics, maritime, defense, and public sector. Enterprises should expect greater availability of private 5G networks as a service. With success stories and trials multiplying, telcos are working to productize these offerings. This can give enterprises ultra-reliable wireless connectivity and the ability to slice networks for critical applications.

Telkomsel and PT Pegaunihan Technology Indonesia, a subsidiary of Pegatron, the Taiwanese OEM manufacturer for major global consumer brands, signed a Cooperation Agreement to deliver the latest 5G connectivity-based technology solutions that support the implementation of high-level AI and IoT in a smart manufacturing facility in Batam; in particular a 5G private network SA infrastructure to ensure reliable and secure connectivity across all production areas.

Enterprise

Telcos have been active in partnerships with enterprises. Many operators partnered with global tech firms: e.g., Google Cloud, Microsoft Azure, NVIDIA just to name a few; these alliances illustrate telcos leveraging cloud and IT expertise externally rather than building all in-house. They are also teaming up with startups and smaller companies as they look at M&A or ecosystem partnerships to gain new capabilities and monetize non-core assets.

Console Connect, PCCW Global’s on-demand platform and automated network for intelligent data movement, unveiled a Private Label SaaS version of its platform at ITW 2025, revolutionising the way partners resell and manage connectivity worldwide.

The fully hosted solution enables partners to offer Console Connect’s full suite of automated carrier-grade network services under their own brand, with a real-time tool to quote, provision and monitor network connections on behalf of their customers.

Stc has inked a contract with solution by stc to establish and develop stc’s internet and telecommunication networks, at a total value of SAR142.4 million (US$38 million). The contract encompasses expanding existing and new network nodes, as well as providing supply, installation, integration, and testing services for equipment, tools, software, and systems, in accordance with the agreed scope of work between the two parties. Under this agreement, the internal network capacity will be upgraded to meet the increasing demands for internet services.

Unified Communications / CPaaS

Looking at the state of unified communications currently, we noticed these trends:

- CPaaS-AI Convergence: AI integration is now a basic requirement for all major CPaaS providers. This includes: AI-generated call summaries (Twilio, Sinch). Conversational IVR and intent detection using LLMs (Infobip, Vonage) and real-time language translation, voice cloning, and smart routing for contact centers. Twilio’s CustomerAI continues to evolve post-OpenAI partnership. Its Segment CDP now pairs with real-time agent co-pilots.

- CPaaS x Telco API Integration: Major CPaaS players (Vonage, Infobip) now surface GSMA Open Gateway APIs (e.g. SIM swap, number verify, device location).This lets CPaaS users (like banks, fintechs, and ride-hailing apps) embed telco-native verification and risk signals directly into communication flows.

- Rise of “Omnichannel Orchestration”: Platforms from vendors like Infobip, Twilio, and MessageBird allow drag-and-drop campaign building across multiple channels.

WhatsApp Business continues to dominate in emerging markets, especially across Asia, Africa, and Latin America; while RCS adoption remains slow.

Deutsche Telekom was one BMO active in the unified communications space; it expanded its partnership with Zoom Communications to include social intranet solution Workvivo by Zoom. Workvivo offers an employee experience platform that simplifies communication and increases employee engagement.

Customer Wins

In Australia, Optus has been selected to deliver a fully managed Network-as-a-Service (NaaS) solution for the Department of Health, Disability and Ageing, supporting its digital transformation. The initial contract runs for three years, with options to extend for another three years, in areas including SD-WAN, voice and data carriage and mobile services.

Following extensive negotiations, China Telecom and Jianzhi Education Technology Group Company Limited, a leading provider of digital educational content in China announced a ‘landmark’ collaboration in integrating Jianzhi’s robust education platforms into China Telecom’s expansive cloud center infrastructure. This could reshape every facet of the digital learning experience with cutting edge AI generated content and digital human technologies, and pave the way for future innovations in digital content distribution.

. . . . .